Abbv Dividend Increase 2025

Abbv Dividend Increase 2025. Abbvie is announcing today that its board of directors declared an increase in the company's quarterly cash. Has announced that it will be paying its dividend of $1.55 on the 15th of february, an increased payment from last year's comparable.

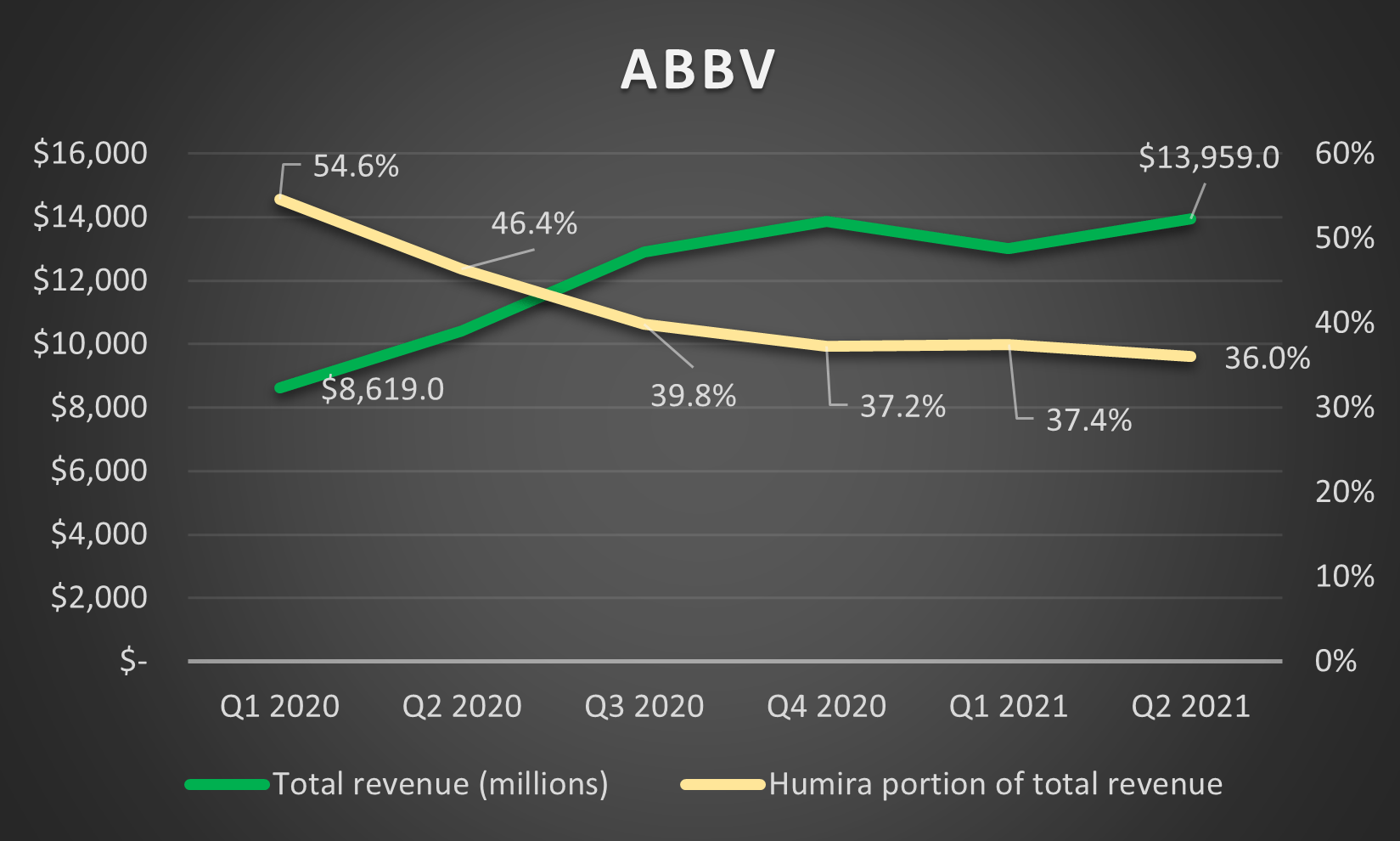

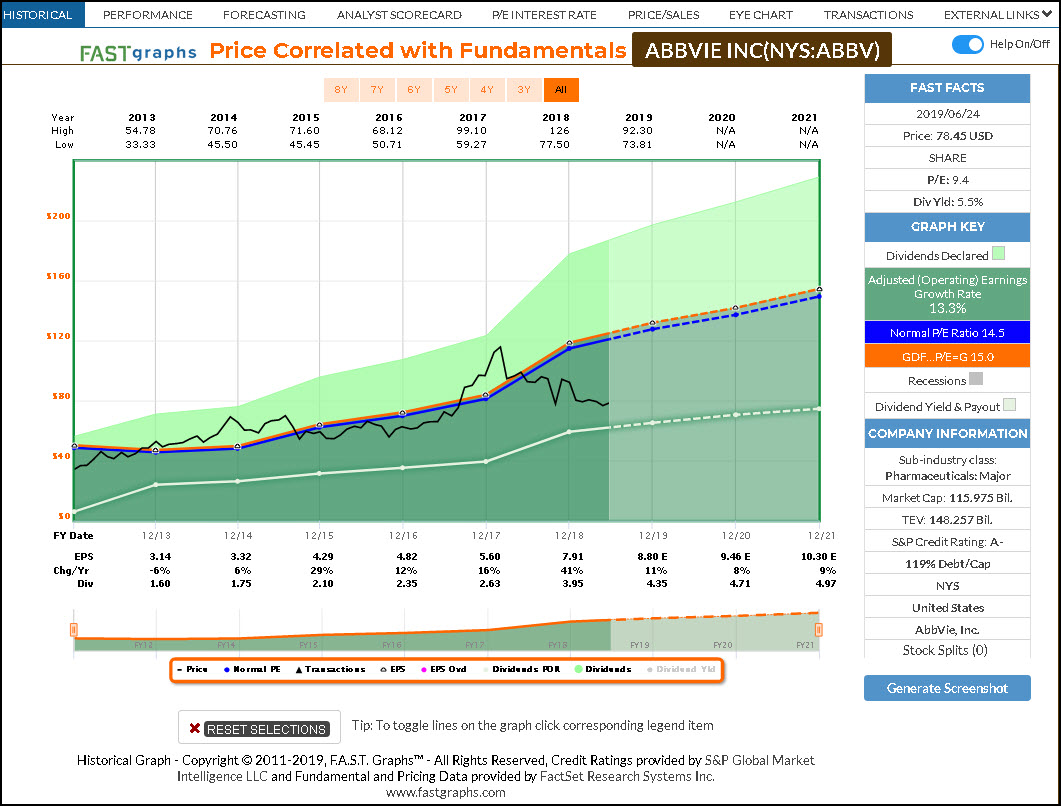

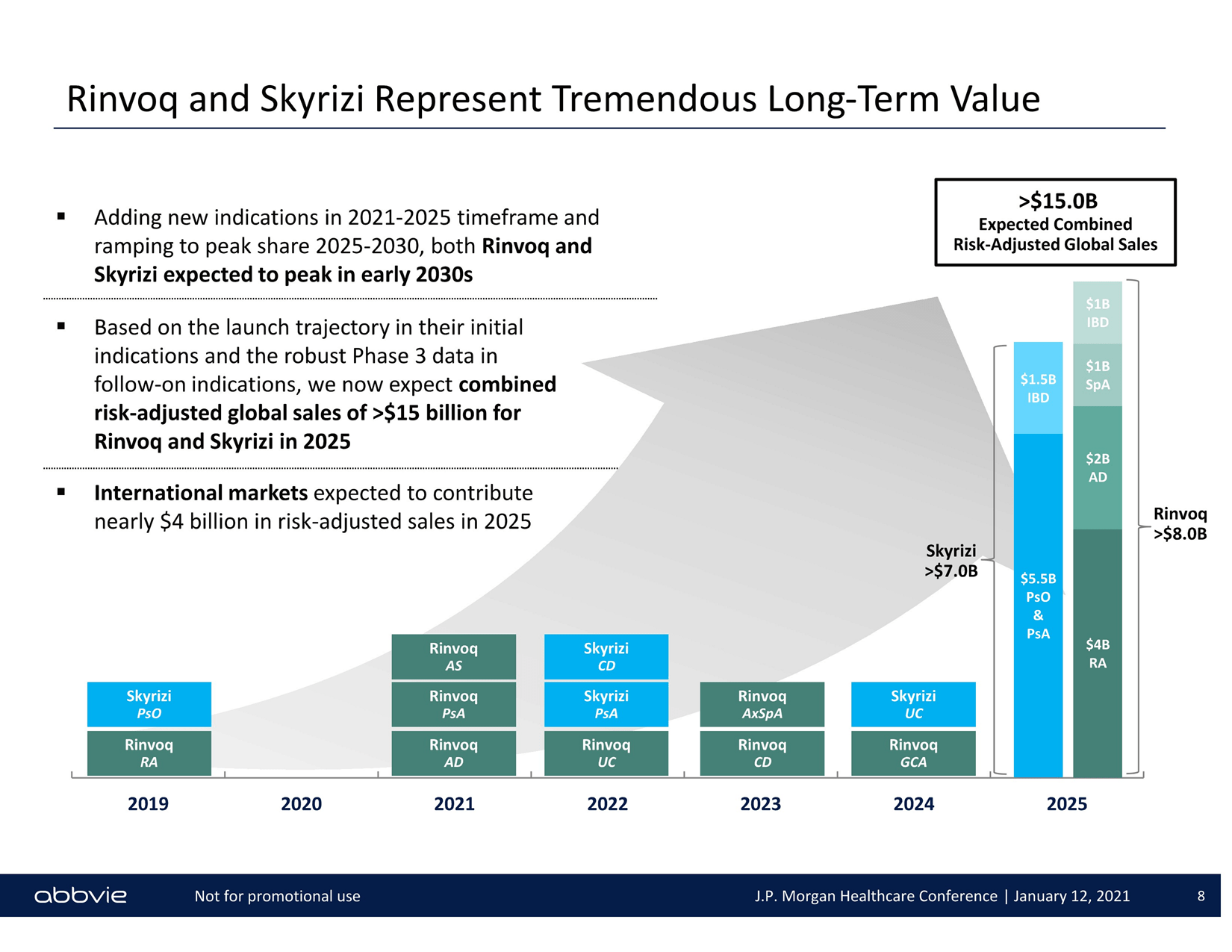

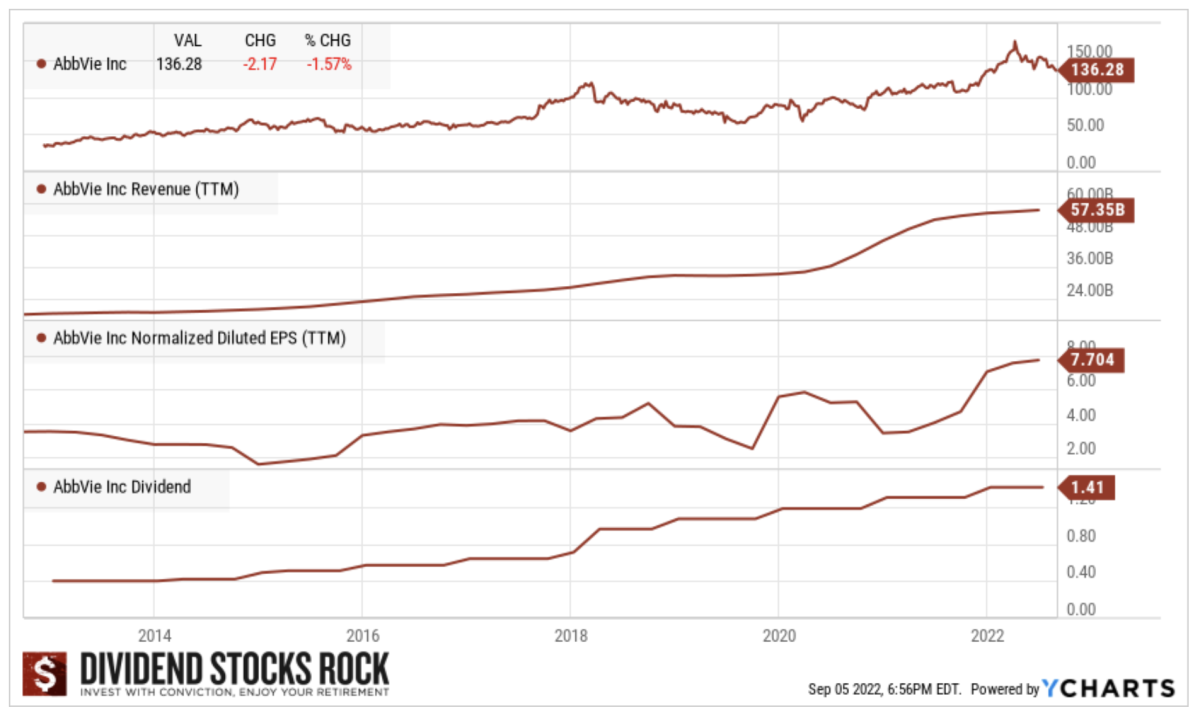

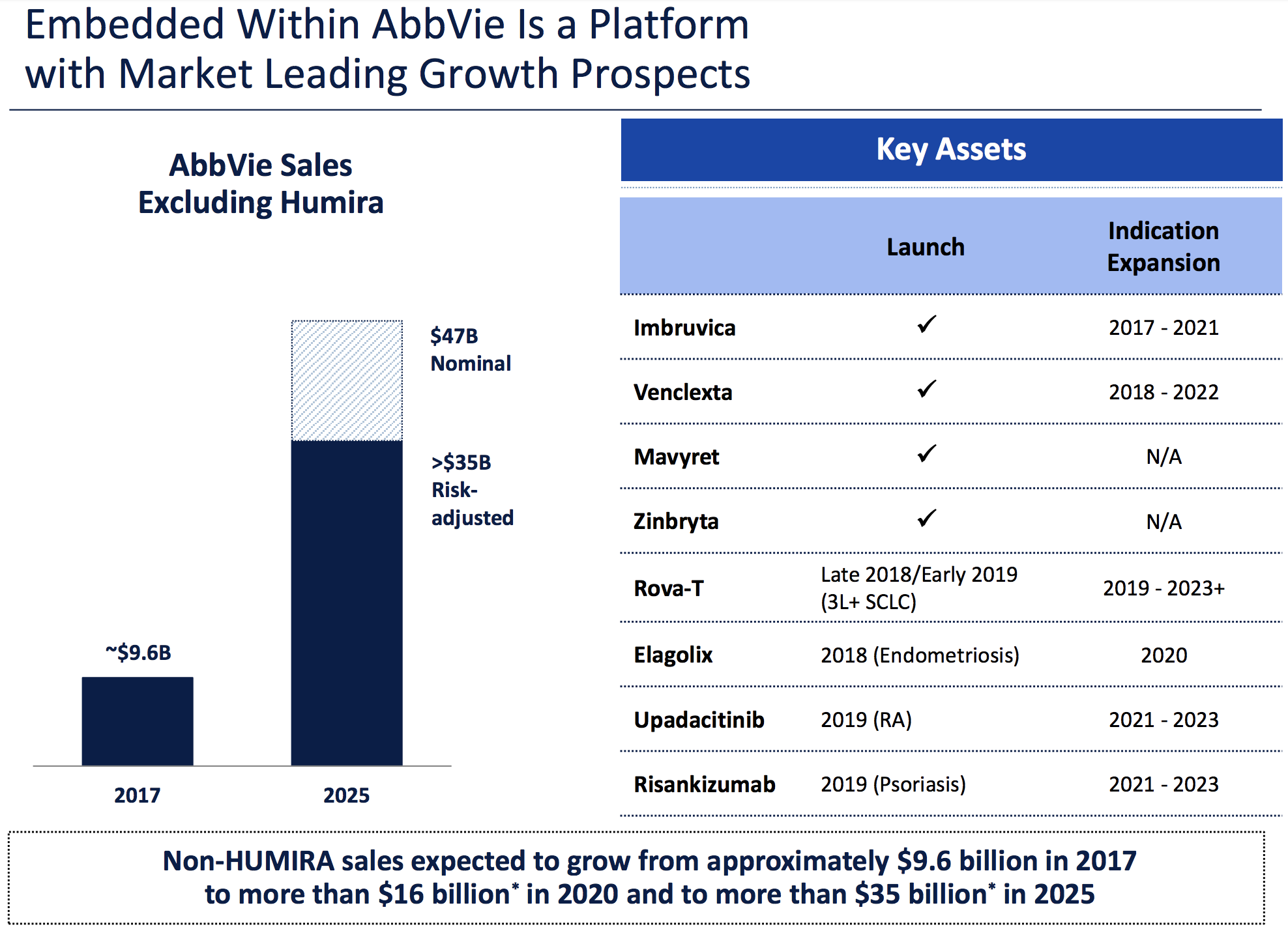

Abbvie is a compelling value play with a 4.5% yield, strong performance, and a 4.7% dividend increase. The company looks decently valued on a cash flow basis as.

Abbv has paid 11 dividends since then, and when they are accounted for, abbv's total return is 61.48%.

AbbVie (ABBV) An Undervalued Dividend Aristocrat Dividend Power, View also the dividend payment date and dividend yield. The #1 source for dividend investing.

AbbVie (ABBV) An Undervalued Dividend Aristocrat Dividend Power, Common stock (abbv) at nasdaq.com. The current dividend yield for abbvie (abbv) stock is 3.62% as of friday, june 28 2025.

Is AbbVie A Good Dividend Stock? Perceived Risks Offer Value (NYSEABBV, Abbv total return level data by. Summing up, abbvie is definitely interesting for its dividend.

AbbVie (ABBV) An Undervalued Dividend Aristocrat Dividend Power, The current dividend yield for abbvie (abbv) stock is 3.62% as of friday, june 28 2025. Abbv) today declared a quarterly cash dividend of $1.30 per share.

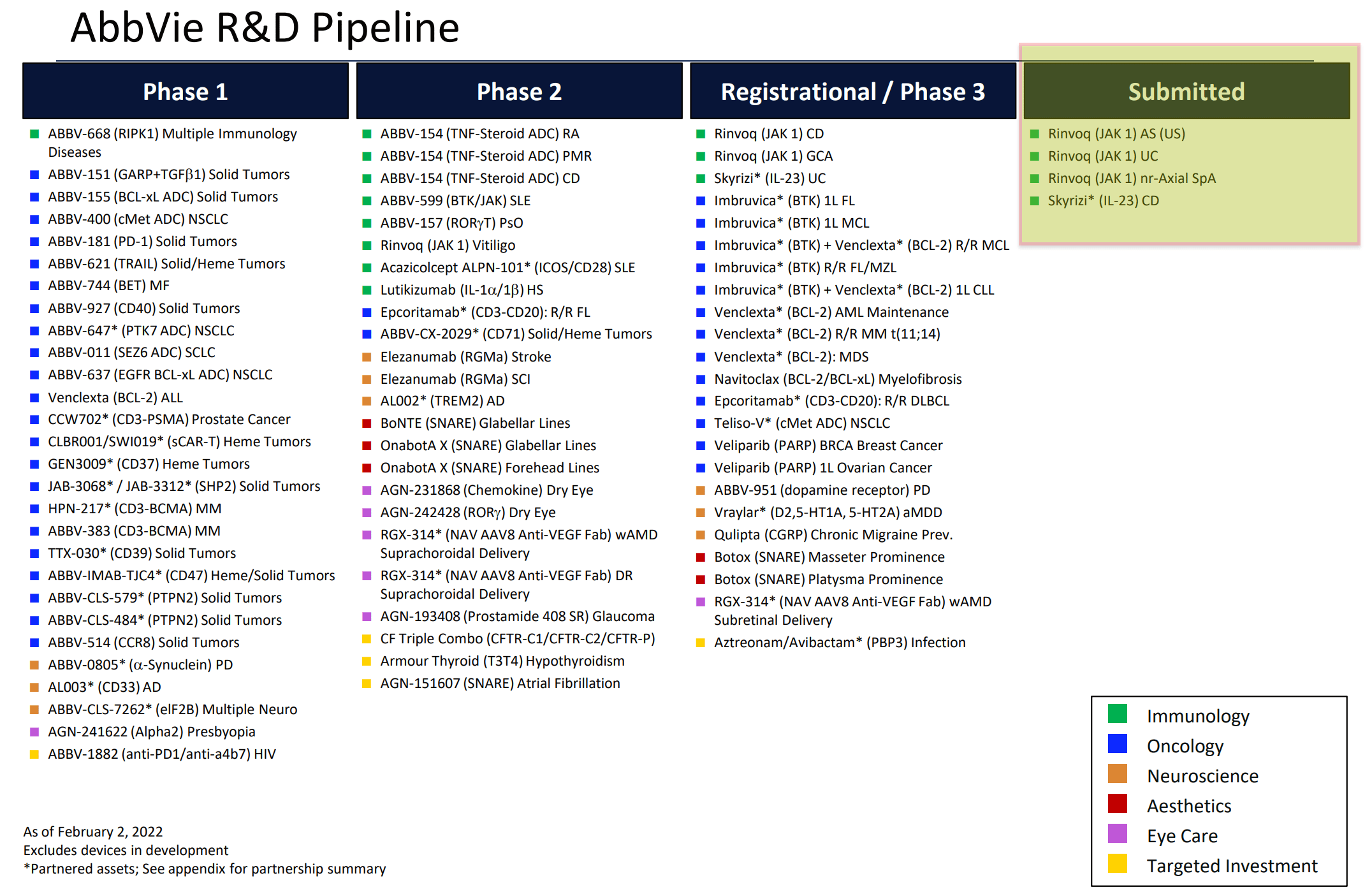

ABBV AbbVie Has It All Growth, Dividend Growth and Compelling, The #1 source for dividend investing. Find out why abbv stock is a buy.

Is AbbVie A Good Dividend Stock? Perceived Risks Offer Value (NYSEABBV, The dividend is paid out quarterly, every three months. Summing up, abbvie is definitely interesting for its dividend.

ABBVIE Stock Dividend Growth Stock To Buy? ABBV stock dividends, Abbvie has a dividend yield of 3.4% and has an annualized dividend growth of 17% for the last decade. Abbvie has an annual dividend of $6.20 per share, with a forward yield of 3.74%.

3 High Yield Dividend Stocks To Buy This Fall That Pay More Than 4, It paid out $6.06 in dividends over the past 12 months, which represents an increase of. The dividend is paid out quarterly, every three months.

AbbVie (ABBV) Intelligent by Simply Safe Dividends, The board of abbvie inc. Stock market insights & financial analysis, including free earnings call transcripts, investment ideas and etf & stock research.

Merck And AbbVie Q2 Pipeline And Dividends In Focus (NYSEABBV, Abbv has paid 11 dividends since then, and when they are accounted for, abbv's total return is 61.48%. The next abbvie inc dividend will go ex.

Abbvie is a compelling value play with a 4.5% yield, strong performance, and a 4.7% dividend increase.